INTRODUCTION

Financial resources are the funds that an organization uses to run its operations. It is very important for a business to manage its monetary resources in order to enhance its performance and financial strength. Finance is essential to run a business whether it is an established or a start-up (Financial Resources, 2018). Businessmen need to look out for an organization that has sufficient funds to operate business activities effectively and efficiently. Good management of financial resources can help an enterprise to grab opportunities and attain organizational goals. The company taken in this report is CareTech Holdings, which is based in the UK.

This project report is focused on principles of costing, business control systems, information and regulatory requirements for financial resources, sources of income, factors that may influence the availability of funds, different types of budget expenditures, the way in which expenditures decisions are taken, managing financial shortfall, actions that needs to be taken at the time of fraud, evaluation of budgets, information required to make financial decisions, relation between health and social care service, impact of financial considerations and ways to improve health and social care services.

TASK 1

1.1 Principles of Costing And Business Control System

Costing and business control system: Costing helps to maintain financial information accurately. Following are costing and business control systems that are followed by healthcare companies:

Cost is the monetary value of a service which is a combination of various expenditures such as labour and overheads. It is the total value that occurs while delivering a service. In CareTech Holdings it is paid by the customers to the company to acquire their employment. Income is the total amount received by the organization from its customers in the form of consideration (Bonomi Santos and Spring, 2013).

Cost-benefit analysis is a technique that is used to analyze the costs and benefits of a particular project. This is used by CareTech Holdings to find out which option will result in higher profits from different plans. A budget is a plan that carries all the information of possible future expenditures and revenues. In CareTech Holdings budgets are generated to estimate upcoming events that may affect organization positively or negatively. Capital is the total amount which is invested by shareholders in a business to run its operations. Cost control is the process of identifying ways in which expenditures and other overheads can be reduced in order to increase profits. A cost center is a department of the company to which costs are allotted as the members are related to investment decisions and profitability.

Outsourcing is a type of agreement in which an organisation hires another company or individual to perform organisational activities and operations. Competitive tendering refers to that process in which companies are invited to take tender which is done for the government. Forecasting is the process of estimating future events, revenues, and expenditures that may take place. Profit is the difference between the cost and income of the firm (Boyne, 2013). Break-even is the situation in which the company earns no profit bears no loss and recovers all the costs from the revenues.

A basic software that can be used by Care Tech Holdings to monitor its financial information is Financial Force Accounting which guides businesses to perform their accounting work accurately.

Cost of principles can be defined as the basic underlying guideline in the process of accounting which is also called historical cost principles. According to this, the assets need to be recorded in the final accounts on the principal or cash amount when it has been acquired by the owner. The rule for the cost is also the same for liabilities, equity, and investments that are recorded in the balance sheet.

1.2 Information Needed to Manage Financial Resources

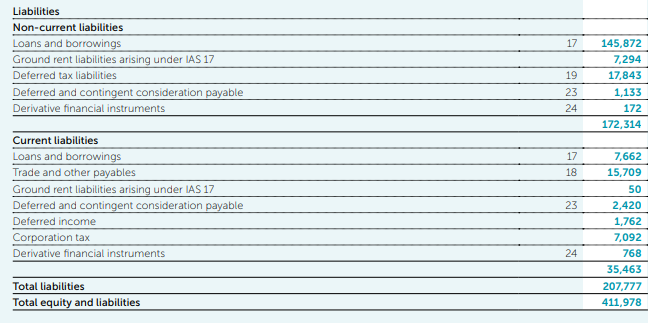

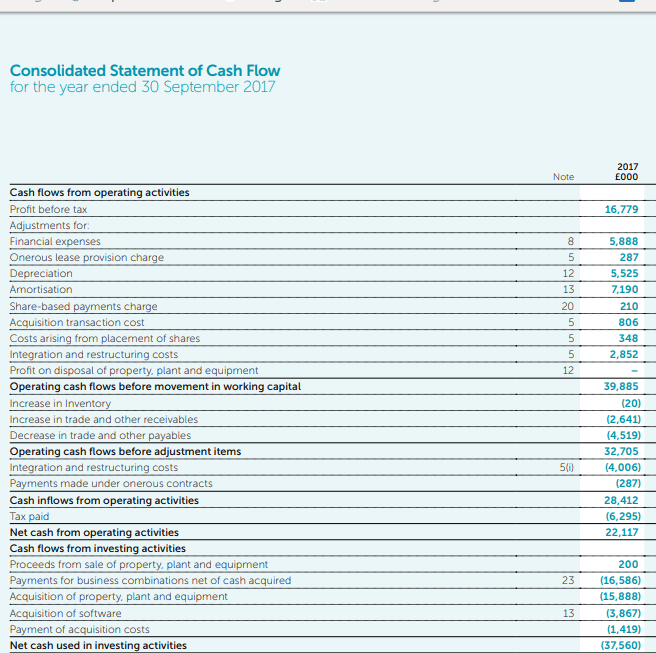

In a company, various information is needed to manage financial resources which can be gathered from financial statements that are balance sheets, income statements, and cash flow statements. In Care Tech Holdings it is identified from these resources. The following information is required to manage financial resources:

Business cost is the combination of various different expenses such as fixed, variable, and semi-variable that may take place while running organisational activities. In CareTech Holding different businesses are faced by the company workforce, equipment that is used to provide services to the customers, finance, and building of the organisation.

The income stream is the money which is generated by the company on a daily basis. It is vital for CareTech Holdings to have information on external influences such as changes in policy, competitive factors, and legal requirements to manage financial resources (Caplan, 2014). These factors may help to get information on the market, competitors, and other consequences that may affect the profitability of the company. The information can be gathered from various sources that are as follows:

1.3 Regulatory Requirements For Managing Financial Resources

Regulations are the controlling and monitoring frameworks that are imposed by the government of a country in the form of legislation to analyze all the activities that are performed by individuals and organisations. Such regulations help to reduce financial fraud and promote equality and honesty while formulating financial reports, consumer protections, effective structure, accountability, etc. In the health and care sector, various regulations are introduced by the government for legislation, code of practice, audits, policies, and accountability (Chrisman and et. al., 2013). All of them are followed by CareTech Holding and described below:

Legislation and code of practices: HMRC is related to the tax authority of a country, which is liable to collect tax from sole proprietors and business corporations. It is the responsibility of CareTech Holdings to file accurate and fair tax returns and pay the proper taxes that are required to be paid.

Audit and accountability: The company house is liable for the audit and accountability activities of healthcare companies. It is a regulatory authority that examines and checks all the financial statements of a company and it's very important for the organisations to provide accurate reports of final accounts to the company house.

Policies: CQC is a Care quality commission that keeps an eye on policies and strategies that are adopted by CareTech Holdings to ensure that these are according to national standards and legislation. It is a liability of the company to follow all the health and safety regulations.

Accountability:

1.4 Systems For Managing Financial Resources in Health and Care Organizations

In an organisation it is very important to manage all the financial resources to evaluate accurately available funds. Proper management of funds can lead an organisation toward success and poor management can decrease effectiveness and profitability (De Bosscher and et. al., 2013) To maintain financial resources accurately CareTech Holdings has to follow different systems that are described below:

Organisation can raise funds from various sources that are government grants, donations, interest on debentures, dividends, and capital gains. It is vital for CareTech Holdings to use these resources appropriately and specifically.

Budgets are formed by board directors and other concerned members of the company who are the administration of budgets. In budgeting firstly the budget is formulated by departments of a company then they have to present it in front of the budget committee. Then approval is provided and the budget is executed in order to manage all the activities.

It is very important to analyze all the information which is recorded in the financial statement this process is known as accountability. It assures that all the recorded information is appropriate (Drucker, 2012).

It is essential for a company to conduct an audit in their company to examine the actual position and performance of the business. An audit can help to analyze whether all the recorded information is appropriate or not and also guides the investors and shareholders to analyse whether the organisation is using all their money effectively or not. Sometimes audit and accountability can be termed the same sometimes as both are done to analyse the transparency of all the data that has been recorded in the financial statements.

TASK 2

2.1 Diverse Sources of Income:

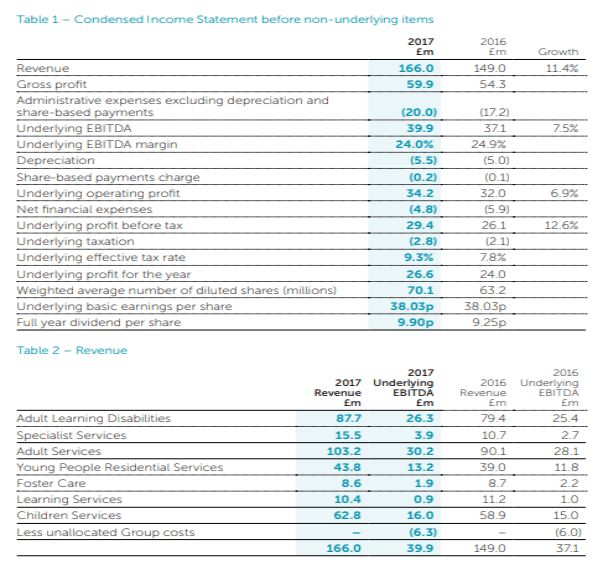

Following are some sources of income for CareTech Holdings that are identified from the financial report of the company.

Public: There are various public sources to generate income these are dividends and earnings from equities. In the Year 2017 company gained income from public resources which was 17849. This is divided into two parts these are basic and diluted. Both are 25.48 per share.

Private: The company can also generate income from private resources these resources are interesting in debentures investment and dividends on preference shares.

Both the above-mentioned resources can be used by CareTech Holdings in order to attain income. This income can be used in operational activities to reach a higher level of success and performance.

|

Information needed to identify |

Amount |

|

Current assets + noncurrent assets |

387402+358827= 746229 |

|

Current liabilities |

30039 |

|

Noncurrent liabilities |

192177 |

|

Net assets |

387402 |

|

Profit for the year 2017 (6 months) |

7013 |

|

Net debt |

-122488 |

|

revenues |

78774 |

|

Gross profit |

28327 |

|

Adult learning disabilities (one year) |

87.7m |

|

Learning services |

10.4m |

|

Specialist services (one year) |

15.5m |

|

Forster care (one year) |

8.6m |

|

Young people residential services (one year) |

43.8m |

2.2 Factors Influencing The Availability of Financial Resources

The following are the factors that may influence the availability of financial resources:

Funding priority: It is the favorable modification to review scores when applications meet the specific criteria. The care tech holdings can raise funds from social insurance contributions, by providing free health care seminars for charities and so on. If a company is not utilizing the funds properly then it may result in a lack of monetary resources.

Agency objectives and policies: These are the purpose that generally helps CareTech Holdings to make future decisions in specific areas and to address the particular services in more direct way.

Private Finance: It is a process where the funds are provided for the major capital investment, where the private organization is contracted to manage and accomplish the public projects. Care Tech Holdings can invest their funds in the London stock exchange market, if funds are not properly invested or gained then it may lead to insufficiency of funds (Effah Ameyaw and Chan, 2013).

Inter-Agency Partnerships: It is the system where two or more agencies are involved. CareTech Holdings does the inter-agency partnership to solve the interdependent problems and to connect children and families with comprehensive services.

Government Policies: It is a course of action or principles which intends to change a particular situation. This company follows the UK government regulations. The policies were made by the governments to improve the quality and safety of healthcare.

Explore Our Free Academic Tools

2.3 Different Types of Budget and Expenditure in Health and Social Care

A budget is a plan prepared in monetary terms, at the beginning of the financial period in order to predict the expected income and expected expenditure incurred during that period. The main body of the budgeting process pertains to three main elements that are Objective, Planning, and control. The budget officer with an accountant prepares the budget framework. After that controlling process starts which identifies the difference between the budgeted and actual costs during a particular financial period. There are some budgets prepared under the organisations (Wuttke and et. al., 2013).

- Service cost center: In this type of cost center service is provided to another department from one department of CareTech Holdings.

- Project management: It includes planning, monitoring, and analysing the efforts of teams and individuals to complete a project with a high level of success. The main challenge for CareTech Holdings in project management is to attain all the planned goals.

- Outsourcing contract: It is mainly used to analyze service level agreements, time frames, and measurements, penalties and rewards, daily basis reviews, and exit strategies for a business. In CareTech Holdings various individuals are hired under outsourcing contracts to perform organisational activities.

2.4 Decisions About the Expenditure

In CareTech Holdings decisions are taken with the help of the following factors:

Environmental analysis: It is a strategic tool that is used to analyse external and internal elements that may affect the operational efficiency of an organisation. These factors are mainly based on business trades, changes in climate, and customers' reactions. It is vital for CareTech Holdings to consider environmental factors while formulating specific decisions (Julian and Oforidankwa, 2013).

Short-, medium-, and long-term planning: Planning refers to the process of estimating and reserving funds for possible future events that may take place. While making a decision it is very important to plan for each type of expense that may occur in the short, medium, and long term.

Financial risk: It is mainly related to the possible risk that may affect the capital structure of the company. It includes loss of monetary resources and fewer sources to deal with financial problems. For CareTech Holdings it is essential to analyse financial risk while making decisions.

TASK 3

3.1 How Financial Shortfalls Can Be Managed

Dealing with financial shortfalls is not easy, it can be managed by reducing expenditures, reserving funds, and virements, and generating income from external sources. It is very important for a company to reserve funds in earlier years so that financial shortfalls that may take place in the long term can be managed easily. If a company is reserving finance then all the finance-related problems can be resolved in less time. Virement is also a good method to manage such types of problems as it can be used by CareTech Holdings to transfer items from one account to another. It is also very beneficial in budgeting as budgets can be transferred from one part to another.

These shortfalls can be managed by generating incomes from external sources that include interest on investments that are made by the company, dividends, and other sources of income. These resources can help CareTech's holdings to manage the shortage of monetary resources. It can also help to generate more and more funds that may be used in an organization's operational activities in order to maximize profits and market share (Ledgerwood, Earne, and Nelson, 2013).

3.2 Actions to Be Taken in the Situation of Financial Fraud

Financial fraud is a situation in which one or more employees of the company may record wrong financial transactions for personal benefits. It is the responsibility of the executives of the organisation to take strict action when it is identified. The following are the actions that need to be taken by CareTech Holdings in the situation of financial fraud:

Analysing financial information to check reliability: The first and major action which needs to be taken by the company is to check the reliability of recorded financial information. It is possible that the right amount of a transaction is not recorded in the final accounts.

Reporting: The accounting department of the company is required to ensure that the right reporting system is used to record every piece of information.

Evidence for fraud: It is essential for the managers of the organisation to find evidence of the fraud so that the actual cause of that fraud can be identified (Maimbo and Melecky, 2014).

All the above-mentioned action needs to be taken by CareTech Holdings in the situation of financial fraud this may help to identify the origin of the problem.

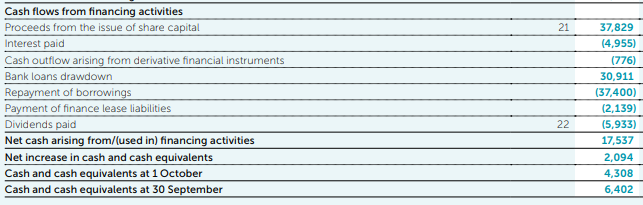

3.3 Evaluation of Budget Monitoring Arrangements in Health or Social Care Organisation

Budget monitoring is the process of analysing all the financial activities of the organisation by examining the information which is recorded in different statements such as balance sheets, income, and cash flow statements. It also helps to identify problems and errors that are recorded purposely or by mistake. In CareTech Holdings budgets are monitored to manage financial resources effectively. Managers of the company use spreadsheet data, evaluate different processes and progress of organisation, analyse cash flow data to determine problems in applied strategies or plans, and control costs in order to monitor the budgets of the organisation (Taylor, Doherty, and McGraw, 2015). A spreadsheet is a computer software that is used to record all the data of an organisation which is related to its activities and all the revenues for a specific time period. The cash flow statement shows all the information related to cash inflows and outflows of a company for a particular time period. It is very important for an organisation to monitor its budgets to control over spending of funds in different activities. All these factors are considered by CareTech Holdings while monitoring the budgets of the organisation.

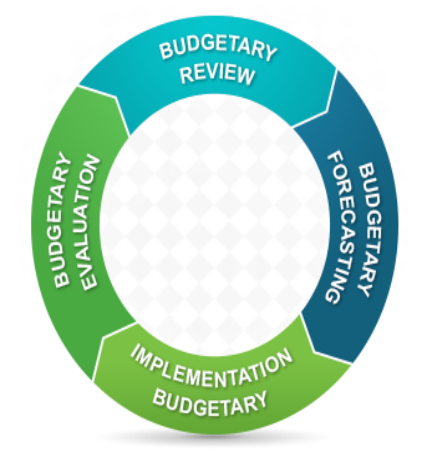

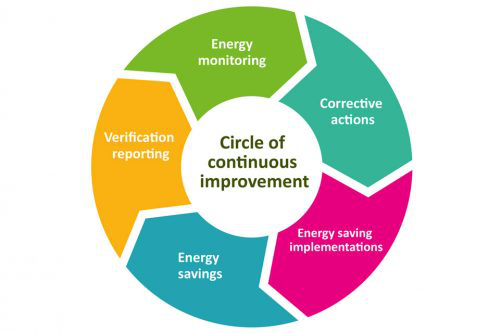

Budgetary circle: It is used by organisations to manage all the budgets in an effective manner. The below budgetary circle consists of four different elements. All of them are as follows:

Budgetary review: In this step, all the budgets are reviewed by the managers in which effectiveness of budgets is also determined.

Budgetary forecasting: This stage is related to forecasting possible future events that may take place and affect organisational situation.

Implementation budgetary: In this step, the budget is implemented by the managers in order to enhance organisational strength and monetary funds.

budgetary evaluation: it is the last stage in which it is evaluated whether the budget is appropriately managed by the departments of the company or not.

TASK 4

4.1 Information Required to Make Financial Decisions

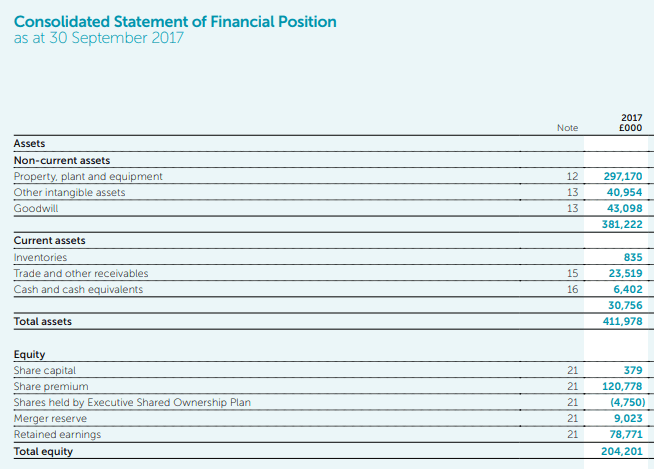

Higher authorities, managers, and board members of an organisation make strategic decisions in order to achieve predetermined goals and objectives. These decisions are taken with the help of recorded data or information from previous years and sources of income which facilitates the decision-making process. Such decisions are made to enhance performance and strengthen financial position. In CareTech Holdings strategic decisions are successfully implemented by senior management with the help of financial data which is recorded in the books. Various information is required to reach any type of judgment or conclusion (Oberthür and Pożarowska, 2013). These informations are as follows:

- Detailed information on the balance sheet that includes assets, liabilities, equities, payables, receivables, investments, and others.

- Information on purchases and sales can be collected from the trading account of the company.

- Broad data of cash inflows and outflows in an accounting year and where it has been spent by the company to acquire assets or any other transaction.

- Accurate information on inventory at the end and start of the financial year.

- Data of various expenditures and incomes, cost-related information and location of business, and interest of customers in services provided by CareTech Holdings.

All this information is required to make any type of decisions in CareTech Holdings that are made for various purposes such as cost reduction, sales increment, increased profitability, accurate time to purchase assets and to identify good sources of funds.

4.2 Relationship Between Services Delivered and Cost and Expenditures of CareTech Holdings

CareTech Holdings provides social services and all the services are different from each other and separated on the basis of cost and expenditures. It is a responsibility of an organisation to deliver qualitative services that are cost-friendly and affordable to customers. If a company is providing services with less cost and generating high profits it means that its business is running smoothly and customers are showing interest in their services (Malmström, Wincent and Johansson, 2013).

The relationship between both these elements can be analyzed with the help of cost-benefit analysis and pricing policies. In cost-benefit analysis, CareTech Holdings analyse the cost and benefits of each service provided and then selects the best service that can result in higher profits for the company. Pricing policy depends on the quality of the service if quality is good then the cost will be high if it is not good then the cost will be lower. Cost or expenditures related to services vary according to the nature and quality of services. Hence, it is suggested to the companies to rationally reduce the cost so that its quality won't be affected. On the other side, it cannot be assured that if the company is spending more on a service then it will result in good quality of service. It is very important for CareTech Holdings to manage both, quality of service and cost or expenditures.

Cost: It is the total amount that needs to be paid by the service user to the service provider. Every client will always try to figure out the actual cost of the service that is going to be acquired by him or her.

Quality: It is the feature of a service that helps to attract a large number of customers for the organisation. If the quality of service is not good then it is not possible to attract and retain customers for a long period.

Services provided by CareTech Holdings are cost-effective and of good quality helping to attract a large number of customers. Sometimes the quality depends upon the money which has been invested by the organisation while enhancing the quality of a particular service. A diagram for quality assurance is as follows:

The above diagram is a combination of five different components. These elements are energy monitoring, corrective actions, energy-saving implementations, energy-saving, and verification reporting. All of them are used by CareTech Holdings in order to improve the quality of the service. The energy of the services is monitored by the Health care professionals so that quality can be measured. Corrective actions are taken if the quality is not good. Energy-saving implementations are used to implement all the relevant actions. Energy saving is used is used if energy is invested more than the actual requirement. Verification reporting is mainly related to the analysis part of the service in which it is analysed whether the service is good or bad.

4.3 Impact of Financial Considerations

Financial consideration of services provided leaves an impact on the users or individuals. It is very important for CareTech Holdings to analyse the ability of customers to pay for the services. The reaction of the individuals totally depends upon the quality of service and access to service (McDonnell and Burgess, 2013). A customer will be able to pay a higher amount if the quality of the service is very good, but if the quality is not good and the company is charging a higher amount for that service it will leave a negative impact on users and next time they may not prefer CareTech holdings to take services. While choosing any service-providing company a user will always try to figure out that organisation is providing good quality services at a low cost or higher cost. If do not find the cost relevant to the service then they may switch to another company that is providing the same service at low cost and with good quality.

Services provided by CareTech Holdings should be easy access for the individuals. For example, the company should provide instant services on customer demand. If customers are getting services on time, then this will help to attract more and more customers. Consumers of services will not consider CareTech Holdings if they have to wait for a service for a long time. Both these factors affect the interest of individuals to make decision of choosing the organisation to acquire services.

4.4 Suggestions to Improve Services Provided by CareTech Holdings

It is suggested to CareTech Holdings that it can improve the services that are provided to its customers with the help of improved financial systems and processes. The company can provide options, supporting evidence, and information that are provided for discussion by financial decision-makers. It can also guide the managers to analyze what customers are willing to acquire and what are their expectations from CareTech Holdings. It can help the organization to provide options to the customers so that they may have various services to choose the best service to acquire (Oberthür and Pożarowska, 2013).

It is suggested to CareTech Holdings that it should evidence its service quality, cost, and staff. It can be mentioned that it is providing the best quality services and charging low cost as compared to others. It can also be evidence that its staff is well educated and skilled. It can improve its services by appropriately using all the available financial resources. Another way to improve services is to analyze all the information which is provided by the financial decision-makers of the company this will help to identify whether the company is performing well or not. It also guides CareTech Holdings to make modifications to its services so that maximum customers get attracted to the organisation (Pearlson, Saunders, and Galletta, 2016).

D1 Evaluation of Systems for Managing Financial Resources

It is very important for CareTech to manage financial resources effectively which is possible with the help of budgeting, sources of income, budget administration, cost centers, auditing requirements, and accountabilities. All these systems can help to manage all the financial resources effectively because budgets can help to reduce overspending as it can estimate them in prior years, sources of income can help to gain it from different sources like government grants, dividends, and interest. Accountability and auditing can assure the accuracy and transparency of financial statements. These systems are used by CareTech Holdings to effectively manage funds.

D2 Analysis of Factors and The Relation Between Services and Cost and Expenditures

There are various factors that can affect the availability of financial resources such as funding priorities, private finance, government policies, agency objectives, and policies. All these factors can influence financial resources because they directly affect the funds of an organisation. There is a close relation between services provided by CareTech Holdings and its cost or expenditures, this relation can be analysed with the help of cost-benefit analysis and pricing policies. The organisation sets costs according to the nature and quality of services. If a company is providing low-quality service then costs and expenses will be lower and high quality will have higher costs and expenditures.

D3 Evaluation of Budget Monitoring Arrangements and Suggestions to Improve Services

In CareTech Holdings budget monitoring is done to maintain all the financial resources that are used to perform all the activities. It is essential for the company to monitor and control budgets to ignore situations of overspending. There are various factors like cash flows and spreadsheets that are used to monitor budgets. All of them can provide accurate information that's why companies use them to monitor expenses. It is suggested that the organisation to provide options and evidence to its customers in order to acquire more market share. Services can be improved with the proper utilization of financial resources.

CONCLUSION

From the above project report, it has been concluded that financial resources are vital for an organisation to operate its activities and achieve goals. It is very important to maintain all the monetary resources in effective manner in order to achieve organisational goals. Service-providing companies can improve their services by providing more options to their customers and appropriate evidence for their services. There are two main factors that may affect individuals' interest that are quality of service and easy access. If quality is good then it may attract more and more customers and low-quality services can decrease the interest of services. If an organisation is providing easy access to the services then it will help to enhance the interest of individuals.

Get help with your finance assignment writing work from the experts at Assignment Desk, at affordable prices.

REFERENCES

- Bonomi Santos, J. and Spring, M., 2013. New service development: managing the dynamic between services and operations resources. International Journal of Operations & Production Management. 33(7). pp.800-827.

- Boyne, G. A., 2013. Managing local services: from CCT to Best Value. Routledge.

- Caplan, M. A., 2014. Financial coping strategies of mental health consumers: Managing social benefits. Community Mental Health Journal. 50(4). pp.409-414.

- Chrisman, J. J. and et. al., 2013. The influence of family goals, governance, and resources on firm outcomes. Entrepreneurship Theory and Practice. 37(6). pp.1249-1261.

- De Bosscher, V. and et. al., 2013. Managing high-performance sport at the national policy level. Managing high performance sport, pp.45-64.

- Drucker, P., 2012. Managing for results. Routledge.

- Effah Ameyaw, E. and Chan, A.P., 2013. Identifying public-private partnership (PPP) risks in managing water supply projects in Ghana. Journal of Facilities Management. 11(2). pp.152-182.

- Julian, S. D. and Oforidankwa, J. C., 2013. Financial resource availability and corporate social responsibility expenditures in a subSaharan economy: The institutional difference hypothesis. Strategic Management Journal. 34(11). pp.1314-1330.

- Ledgerwood, J., Earne, J. and Nelson, C. eds., 2013. The new microfinance handbook: A financial market system perspective. The World Bank.

- Maimbo, S. M. and Melecky, M., 2014. Financial sector policy in practice: benchmarking financial sector strategies around the world. The World Bank.

- Malmström, M., Wincent, J. and Johansson, J., 2013. Managing competence acquisition and financial performance: An empirical study of how small firms use competence acquisition strategies. Journal of engineering and technology management. 30(4). pp.327-349.

- McDonnell, A. and Burgess, J., 2013. The impact of the global financial crisis on managing employees. International Journal of Manpower. 34(3). pp.184-197.

- Oberthür, S. and Pożarowska, J., 2013. Managing institutional complexity and fragmentation: The Nagoya protocol and the global governance of genetic resources. Global Environmental Politics. 13(3). pp.100-118.

- Pearlson, K. E., Saunders, C. S. and Galletta, D. F., 2016. Managing and Using Information Systems, Binder Ready Version: A Strategic Approach. John Wiley & Sons.

- Taylor, T., Doherty, A. and McGraw, P., 2015. Managing people in sports organizations: A strategic human resource management perspective. Routledge.

- Wuttke, D. A. and et. al., 2013. Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. Journal of Business Logistics. 34(2). pp.148-166.

- Online

- Financial resources. 2018. [Online]. Available through:

<https://bizfluent.com/about-6321989-definition-financial-resources-business.html>

Company

Company